The Agrarian Credit Corporation ( further "ACC") has reported its 2023 results. The World of NAN editorial analyst gathered the most interesting facts from the financial report. Note that the results are based on separate reporting, that is, without taking into account Kazagrofinance.

In 2023, ACC earned interest income of 147.5 billion tenge, which is 24% more than in 2022. However, ACC actually received only 89.5 billion in real money, indicating that 40% of loans are likely to have some arrears problems. Admittedly, this is better than the 2022 figure of 44%.

Interest expenses rose by 30% to 80 billion tenge. Overall, this was due to a 27% increase in debt to the Government of Kazakhstan. In 2023, ACC received 140 billion tenge of loans from the Ministry of Finance with a nominal rate of 0.01% per annum. The funds went for Ken-Dala program, 60.9 billion tenge of them were sent to Halyk Bank and BCC, which further lent to farmers, and the remaining 79.1 billion were issued directly. The company itself estimates that the market rate on the loan should have been 17.71-18.25%, so it estimated the income of 27.6 billion tenge as a government subsidy.

In general, the government subsidies received (in the form of low-rate loans) in 2023 are estimated at 31.5 billion tenge, while in 2022 the same figure was as much as 44.5 billion tenge. As a result, other income, mainly consisting of subsidies, amounted to 11.5 billion tenge, plus ACC received 10.3 billion tenge from Kazagrofinance in the form of dividends. Net income for 2023 amounted to 20.9 billion tenge, 82% higher than in 2022. Without the recently merged Kazagrofinance, net profit growth would have been much more modest.

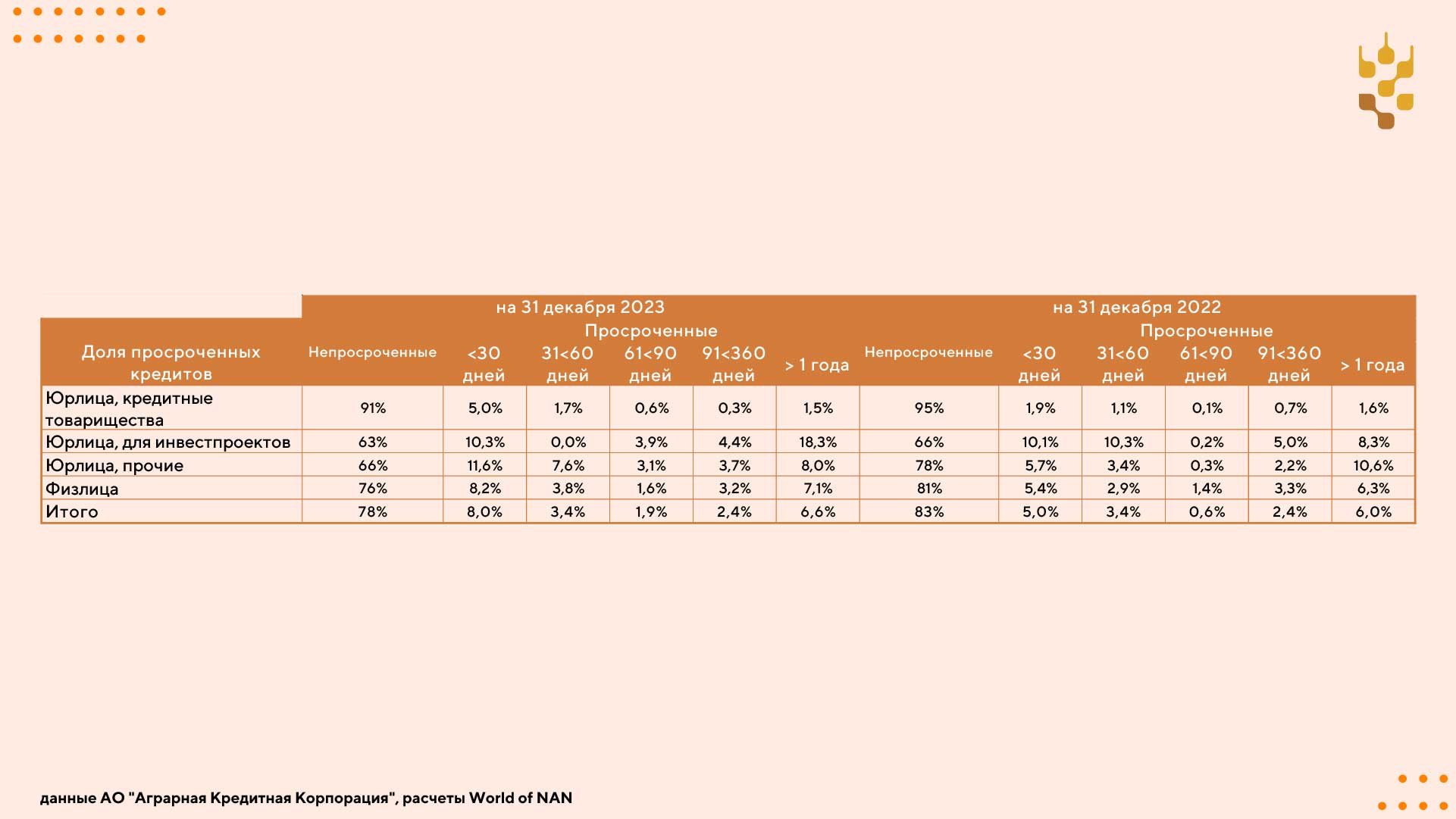

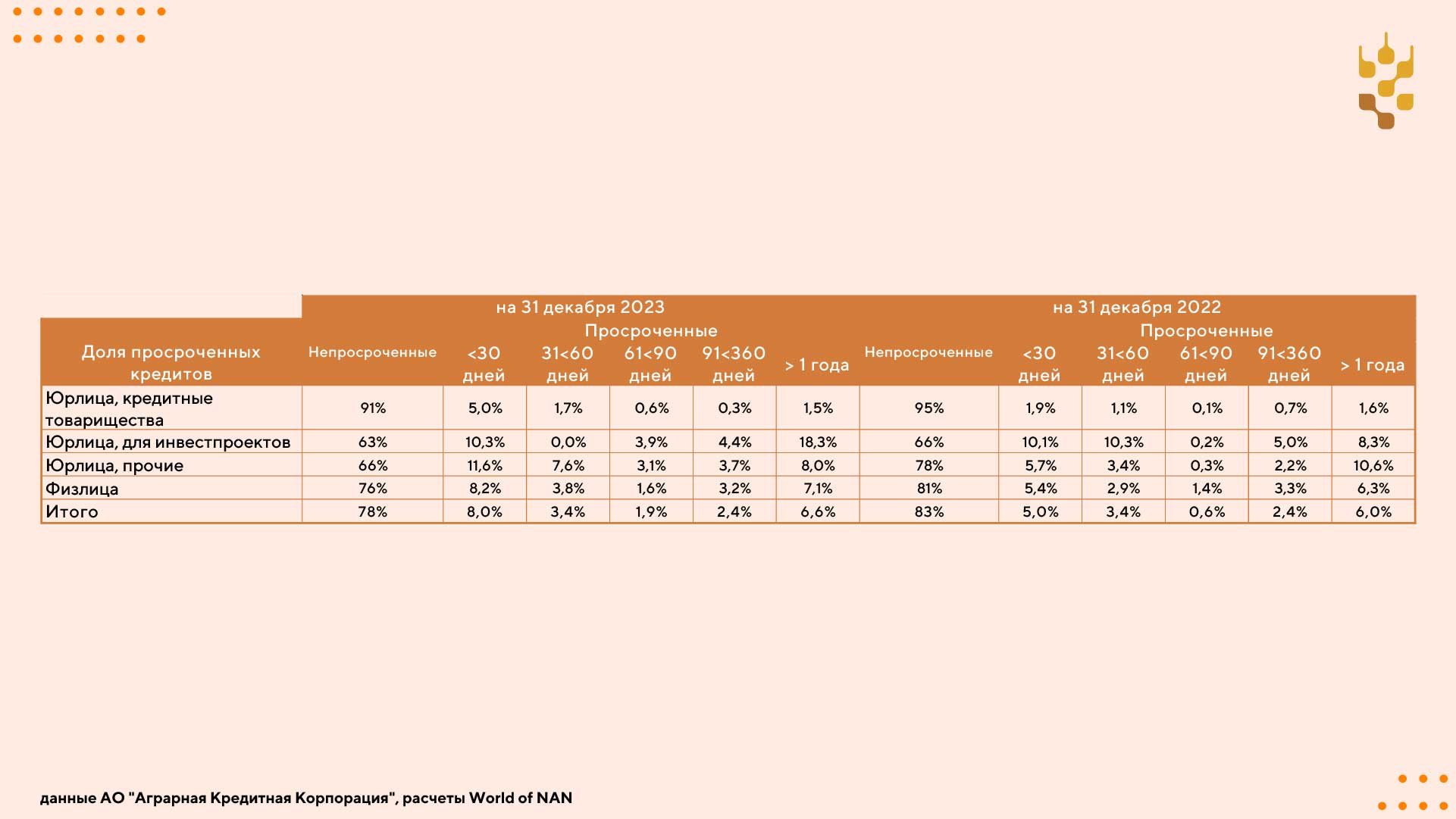

The quality of ACC's loan portfolio in 2023 declined markedly. The share of overdue loans increased from 17% to 22%. The increase in overdue loans in all four categories presented. The situation is the worst among legal entities that received loans for investment projects, the share of arrears reaches 37%.

The most severe situation is observed among other legal entities, whose arrears increased from 22% to 34%. The share of total overdue loans up to 30 days increased most of all (from 5% to 8%), which indicates an increase in agrarians who began to experience financial difficulties precisely after the end of the last harvest.

Смотрите больше интересных агроновостей Казахстана на нашем канале telegram,

узнавайте о важных событиях в facebook и подписывайтесь на youtube канал и instagram.

Обсуждение