The analyst of the World of NAN editorial board reviewed the financial status of Sultan-Elevator-Melnichno-Macaronnyi Kompleks JSC (hereinafter - "Sultan-EMMK"). And found some inconsistencies that raise a lot of questions.

The company is known for its pasta products, sales of which account for the bulk of its revenue. However, we were also interested in the corporate structure and possible consequences of this structure and the privatization of the state ownership in 2022. As a reminder, the state directly owned a 13.99% stake in the JSC until February 2022.

In 2022, revenue of Sultan-EMMK amounted to KZT10.8 bln, which is 38% more than in 2021. However, the cost of production amounted to KZT8.6 bln, and other expenses (sales, marketing and administrative) brought the company's operating profit to KZT1 bln, which is nevertheless almost 3 times higher than in the previous year. On the other hand, interest expenses on borrowings rose from 206 to 461 mln tenge and thus net profit amounted to 439 mln tenge.

However, the most interesting thing is to whom Sultan-EMMK sells its products. It turns out that the company earned 9.9 billion tenge from the sale of goods to related parties (Okan-Agro LLP, Sultan Confectionery JSC and JV Okan Kazinter JSC). Of these, KZT9.6 bln goes to JV Okan Kazinter JSC. Opening the statements of Okan Kazinter, it can be seen that it is an intermediary company with almost zero profit, which sells the same products further to affiliated LLP "Sultan-Marketing".

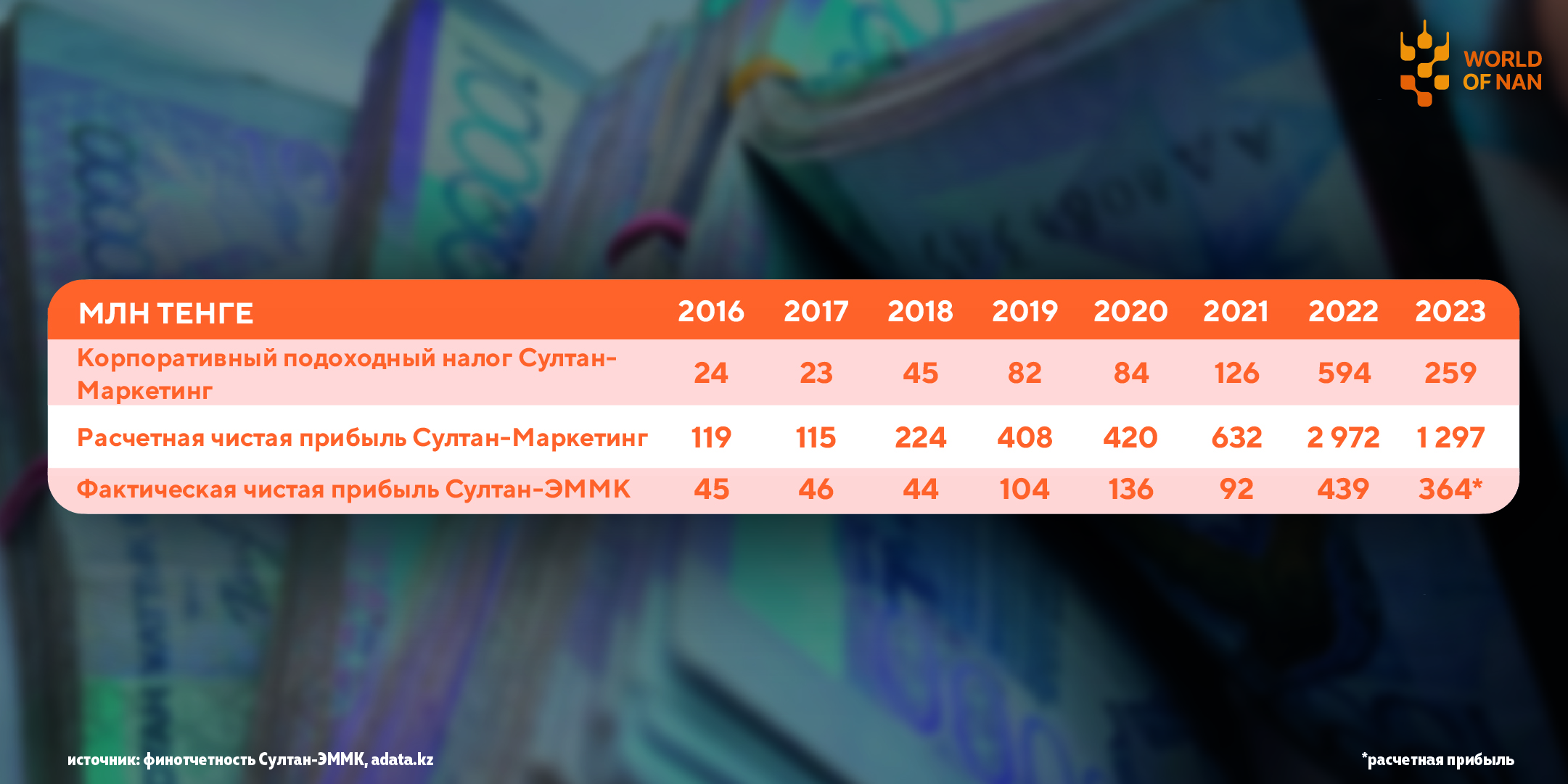

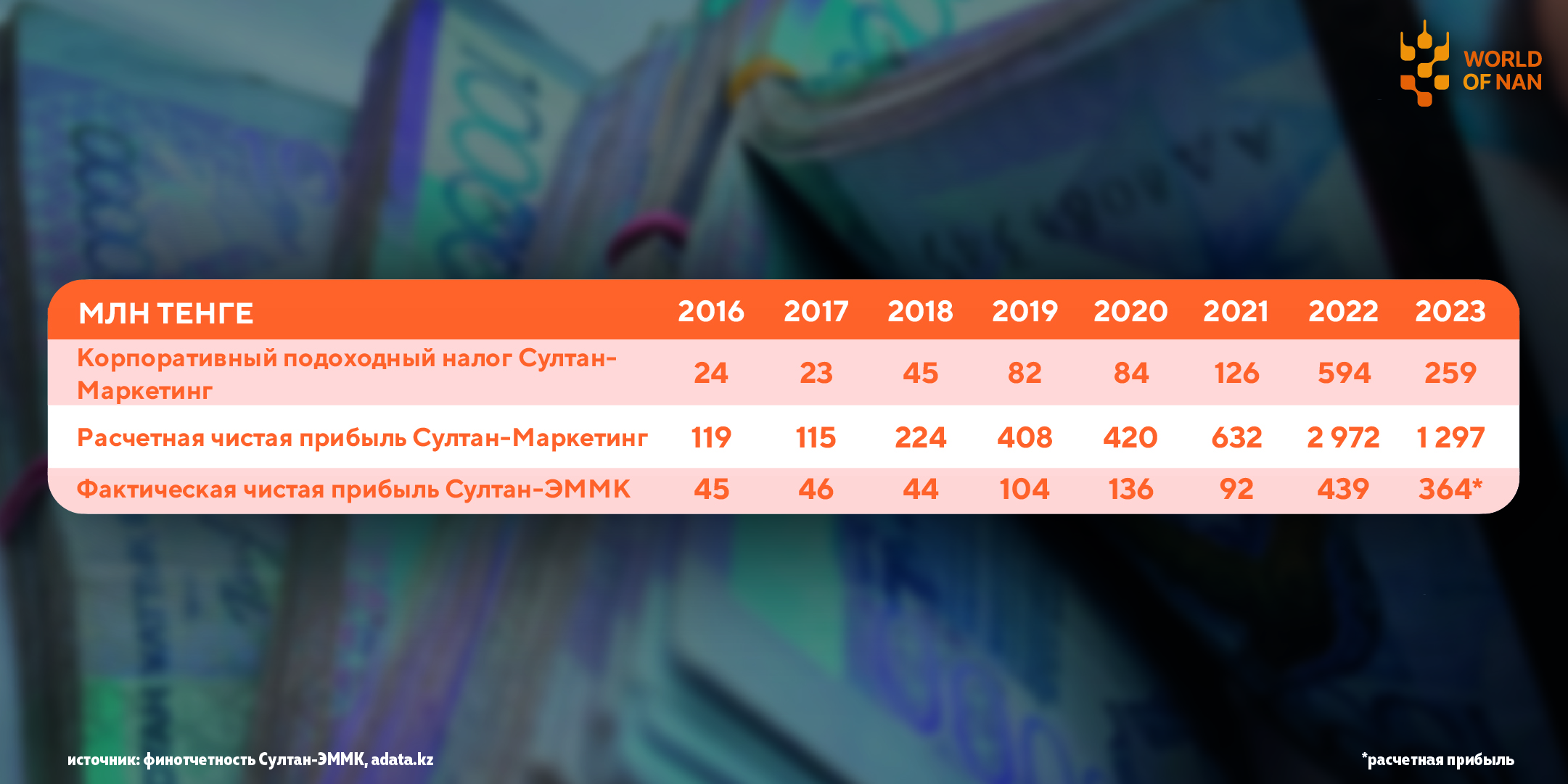

Hence there is a reason to believe that Sultan-EMK may be under-receiving profits because it sells the products at an undervalued price, which Sultan-Marketing then resells for market prices, receiving higher profits. Where does this assumption come from? We do not have financial statements of Sultan-Marketing, but according to tax payments, the company paid 594 mln tenge of corporate income tax. This means that Sultan-Marketing's net profit may have amounted to almost KZT3 bln, assuming an effective tax rate of 20%. That is, Sultan-Marketing's estimated net profit is 6.5 times higher than Sultan-EMMK's net profit.

One might ask, "what difference does it make how they market their products?" There is a difference, because earlier 13.99% stake in Sultan-EMMK belonged to the state, while Sultan-Marketing LLP is fully owned by the Turkish company. That is, if the above assumption is correct, then the state before the sale of its share received quite a large profit, which went to Turkish beneficiaries.

Also possible understatement of profit by Sultan-EMMK partially affected the valuation of the state's share at its sale. The independent valuation amounted to KZT7.36 bln for the whole company and KZT721 mln for the 13.99% stake. That is, if Sultan-EMMK's financial performance had been higher, the valuation would have been higher, and the budget would have received more money from the sale of its stake. As a result, this stake was sold at the auction with price reduction. The buyer waited for the price to fall to the minimum limit of 360.4 mln tenge and bought this share. The buyer was Sultan-Marketing LLP judging by tax reports. In conclusion, it can be concluded that Sultan-Marketing, earning more than Sultan-EMMK, accumulated money (which was under-received by the state) and then bought out the state's share at a price, which turned out to be undervalued precisely because of this scheme.

Смотрите больше интересных агроновостей Казахстана на нашем канале telegram,

узнавайте о важных событиях в facebook и подписывайтесь на youtube канал и instagram.

Обсуждение