As a rule, beginner Kazakhstani agricultural producers, before starting their business, face a number of questions: how to get financing, where to get agricultural machinery and find partners.

The first issue is helped by support implemented through state and industry programs providing soft loans. However, in terms of agricultural machinery, the services of KazAgroFinance JSC can provide significant assistance, because it is through this state-owned company that agricultural machinery can be obtained on favorable terms with the possibility of a buyout.

This concerns not only beginner farmers, but also existing, established businessmen. After all, the initial purchase, as well as renewal of the fleet of agricultural machinery, is the main condition for good yield.

More on that read below.

A bit of background information - what does KazAgroFinance do?

Photo by zakon.kz

KazAgroFinance was established on the 28 December 1999 by the Government Decree. Its main mission is to promote the renewal of agricultural machinery and equipment in Kazakhstan. The Company achieves this by providing financial and leasing services.

For reference: leasing is a type of financial services, a type of credit for acquisition of fixed assets and other goods by enterprises, individual and legal entities.

The lessor undertakes to acquire ownership of the property specified by the lessee from the seller indicated by him/her and to provide the lessee with this property for a temporary use for payment, with or without the right of buyout. More often than not legal entities use leasing as a financing tool, as it is connected with tax benefits.

"Last year we celebrated our 20th anniversary. It should be noted that today we are, in fact, a monopolist in the market of leasing of agricultural machinery. All major suppliers of agricultural machinery, all major players that exist in the agro-industrial complex, have worked with us one way or another and continue to work with us today", - said the manager of the Credit Leasing Projects Department of JSC "KazAgroFinance" Dzhandos Takenov.

Let us elaborate on the services of the company.

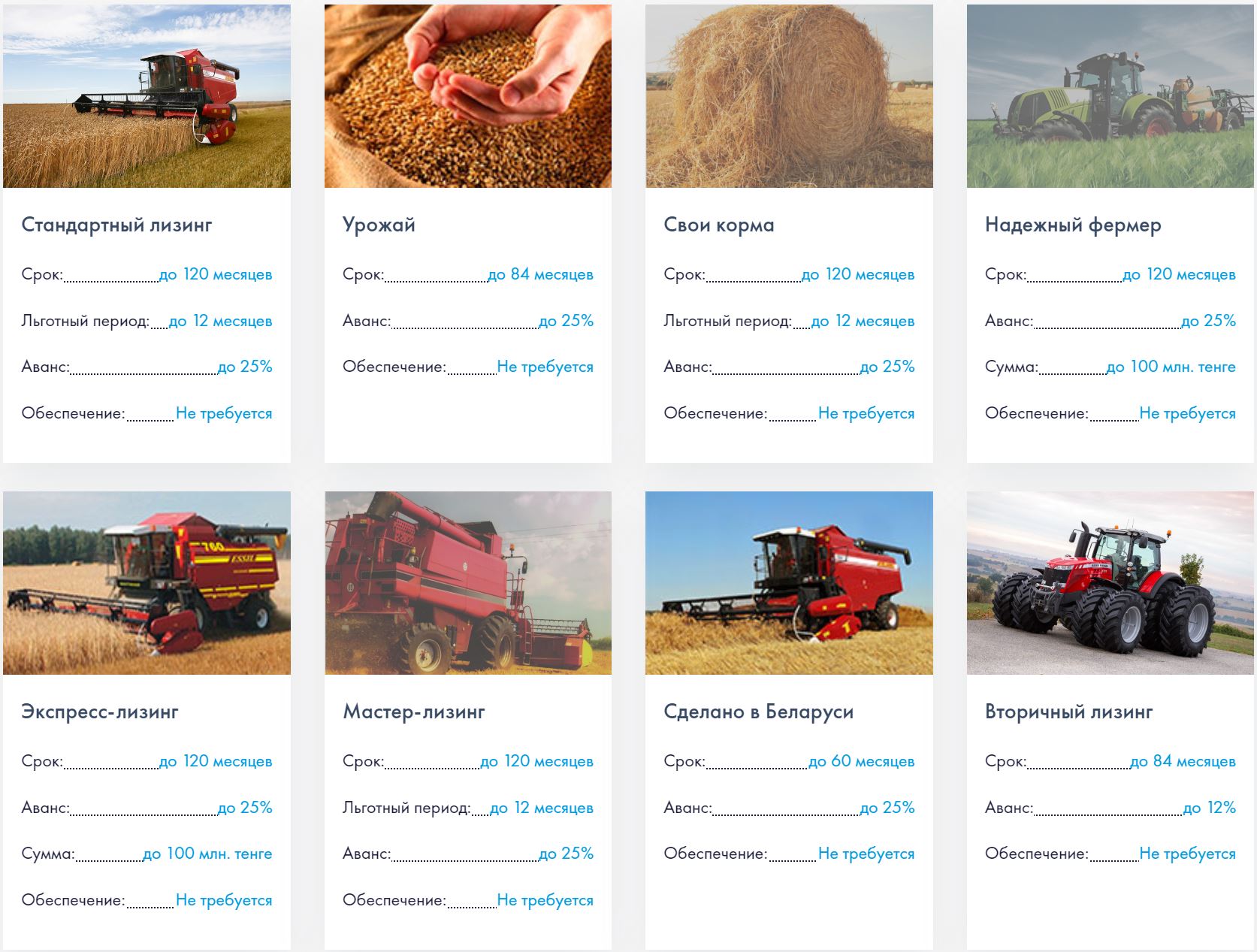

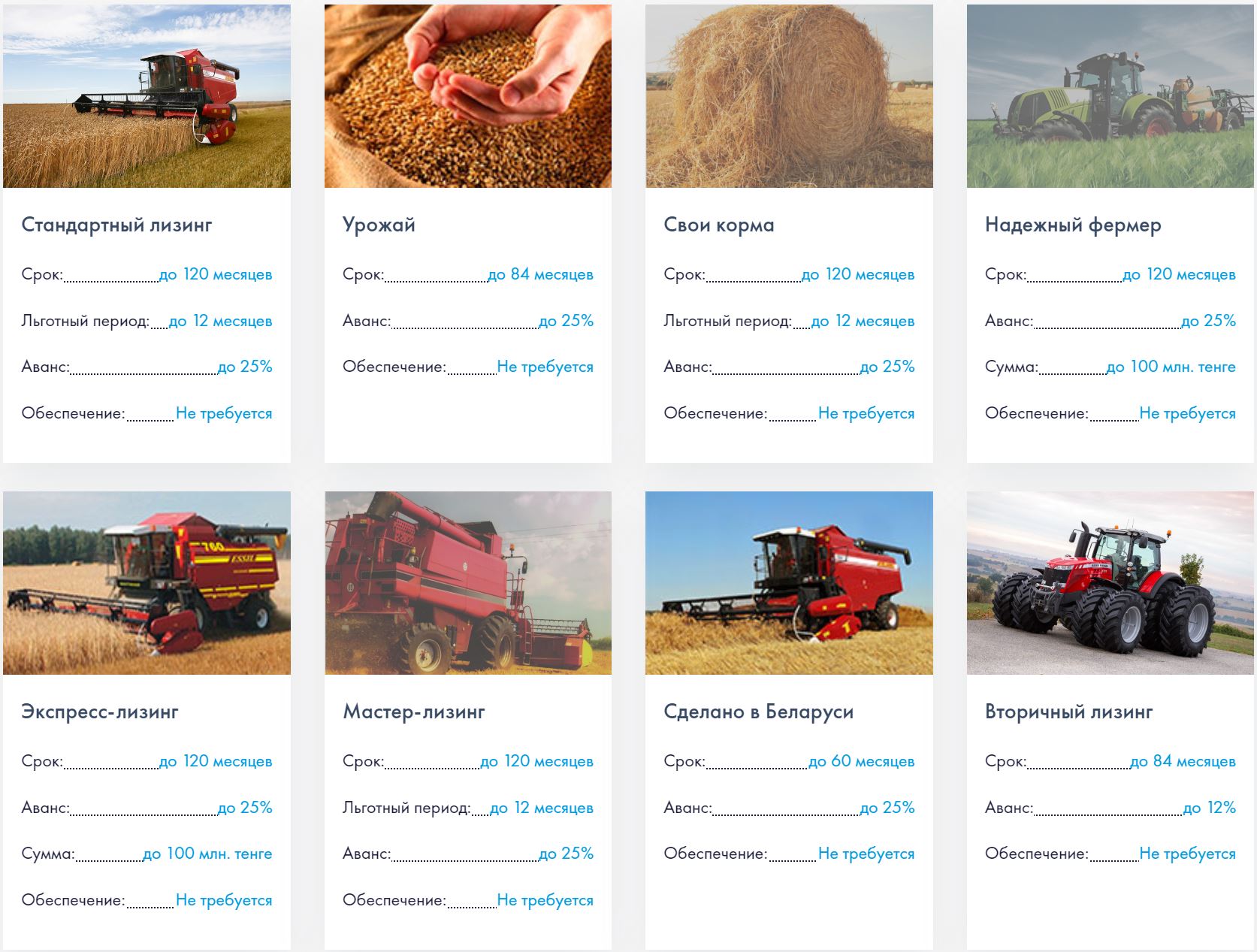

"As for the conditions of leasing equipment, we have a very large line of products that cover all areas of interest to farmers. The standard interest rate is 17% per annum, 10% of which is paid by the state as subsidies. The final rate for the producer is 7%. In addition, there are investment subsidies, when the state covers part of the expenses incurred by an agribusiness entity in the amount of 25% of the cost of acquired equipment. The financing period is 5 to 10 years, with an advance payment of 15 to 25%. All this is calculated depending on the type and cost of equipment," said Dzhandos Takenov.

Thus, JSC "KazAgroFinance" covers such areas as "Agricultural Machinery", "Special Equipment", "Vehicles", "Cargo Wagons", "Equipment", as well as "Replenishment of Working Capital".

Under each direction, an agricultural producer can obtain the necessary equipment or service on various terms (sometimes without re-examination of the application within a year, sometimes expeditiously, sometimes with extended financial limits, etc.).

It should be noted that the service of financial leasing is provided without collateral, as the purchased equipment itself acts as collateral, more on that will be said below.

More details about conditions of each particular direction with the list of documents and description of procedures can be read here.

As far as state subsidies are concerned, as mentioned above, they are granted either to partially cover the interest rate on loans, or to lease technological equipment and agricultural machinery.

As far as state subsidies are concerned, as mentioned above, they are granted either to partially cover the interest rate on loans, or to lease technological equipment and agricultural machinery.

Alternatively, to reimburse part of the expenses incurred by the subject of the agro-industrial complex when making an investment.

More details on the rules and conditions of subsidies can be found here.

In all regions of Kazakhstan KazAgroFinance is represented by 16 branches, which makes it accessible to farmers from any part of our country.

In addition, it has a wide base of suppliers of goods, equipment and services, which can greatly improve the lives of agricultural entrepreneurs, especially beginners.

The mentioned base can be found here.

Promoting the reputation of a farmer - improving support conditions

"The financing terms and conditions are the same in most cases, however, there are separate programs for those clients, who have a long history of partnership with us and a good credit history. We're referring to the "Reliable Farmer" program. It provides more favorable terms on remuneration, the amount of advance payment, as well as other terms", - says Dzhandos Takenov.

According to him, agricultural equipment needs to be renewed approximately every 10 years.

"The cost of equipment increases every year, including domestic equipment. Not every agricultural producer can buy it only at his or her own expense. It is for this purpose they appeal to us. Furthermore, one of the advantages of financial leasing is that there is no need in the collateral, as the purchased equipment will serve as a collateral. That is you apply to us for financing, we consider your application, in case of approval you pay the advance payment, then we purchase the chosen equipment for you and transfer it to you for leasing. The equipment is not registered in your name right away, but immediately after the fulfillment of all your financial obligations, equipment is registered in your name," - said Dzhandos Takenov.

As far as state subsidies are concerned, as mentioned above, they are granted either to partially cover the interest rate on loans, or to lease technological equipment and agricultural machinery.

As far as state subsidies are concerned, as mentioned above, they are granted either to partially cover the interest rate on loans, or to lease technological equipment and agricultural machinery.

Обсуждение