The uses of rapeseed oil are very diverse: it is used in the food industry, technical industries and even as fuel for some types of machinery. At the same time, it is one of the most useful products for humans. For more information see the material of the World of NAN portal.

Rapeseed oil is a valuable product of oilseed processing. High content of poly- and monounsaturated fatty acids Omega 3, 6 and 9 slows down thinning of vascular walls, prevents blood clots, lowers cholesterol levels, prevents the general accumulation of cholesterol on the walls of blood vessels. Despite the fact that these acids seriously affect the function of the circulatory system, they are not synthesized by the body itself. In Germany, 70-80% of citizens consume rapeseed oil as food, and in some other European countries this product is officially considered to be a medicine.

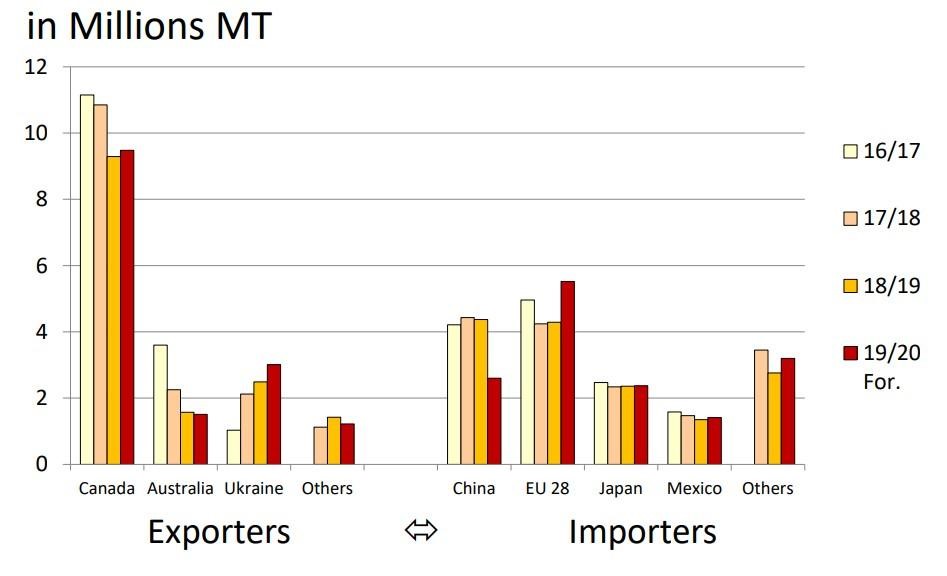

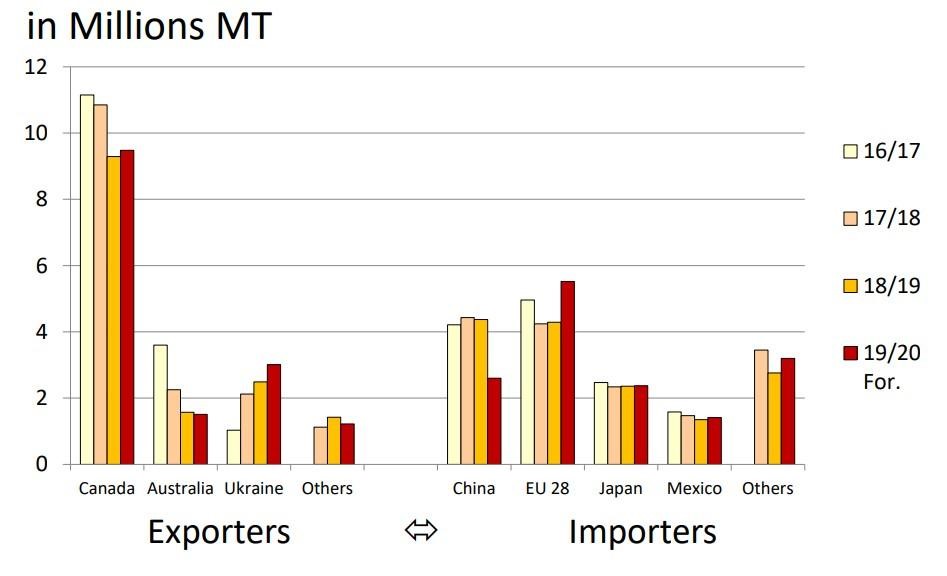

Data show that Canada is the main world exporter of oil-seed of rapeseed. The spring rapeseed area in this country is about 10 million hectares. With an average yield of over 20 cwt/ha, the gross yield of oilseeds rape reaches 20 million tonnes, half of which is exported. Rapeseed exports are increasing rapidly in Ukraine, as demand for oilseeds in Europe is provoking farmers in that country to reasonably increase the area under winter rapeseed.

Australia is the next leader in exports. Despite the climatic difficulties of growing this crop on the mainland, farmers export more than one and a half million tons of rapeseed on average.

Oilseed rape exports and imports (mln tons)

Source: Oil Word 21.02.2020

Large volumes of rapeseed oil imports traditionally come from the European Union, as the culture of using rapeseed oil in food, as well as the use of oil as biodiesel contributes to the demand for rapeseed up to 6 million tons, despite its own annual production of over 16 million tons.

Japan and China are also major importers of rapeseed. These countries account for more than 6 million tons of rapeseed annually.

Pakistan and the United Arab Emirates import more than 1.5 million tons. These countries represent a promising export destination for our farmers, as well as provide an opportunity to promote products to the Middle East.

As for Kazakhstan's exports of oilseeds and rapeseed oil, the volumes supplied and countries vary from year to year.

Export of oilseeds and rapeseed oil from Kazakhstan, tons 2015-2019

|

year

|

Country

|

Amount, ton

|

|

Rapeseed seeds

|

Rapeseed oil

|

|

|

|

|

|

|

2019

|

Russia

|

24 214,00

|

5,40

|

|

|

Belarus

|

21,00

|

|

|

|

Kyrgyzstan

|

|

0,80

|

|

|

China

|

|

643,00

|

|

|

|

|

|

|

2018

|

Russia

|

52 989,10

|

12,60

|

|

|

Kyrgyzstan

|

|

11,40

|

|

|

Mongolia

|

4 172,00

|

|

|

|

|

|

|

|

2017

|

Russia

|

30 718,00

|

12,20

|

|

|

Mongolia

|

3 955,00

|

|

|

|

China

|

|

340,00

|

|

|

|

|

|

|

2016

|

Russia

|

49 817,00

|

5,50

|

|

|

Kyrgyzstan

|

5 073,00

|

|

|

|

|

|

|

|

2015

|

Russia

|

26 301,00

|

8,10

|

|

|

Belarus

|

60,00

|

|

|

|

Kyrgyzstan

|

45,00

|

|

|

|

Mongolia

|

931,00

|

|

Source: Data from the Statistics Agency of the Republic of Kazakhstan

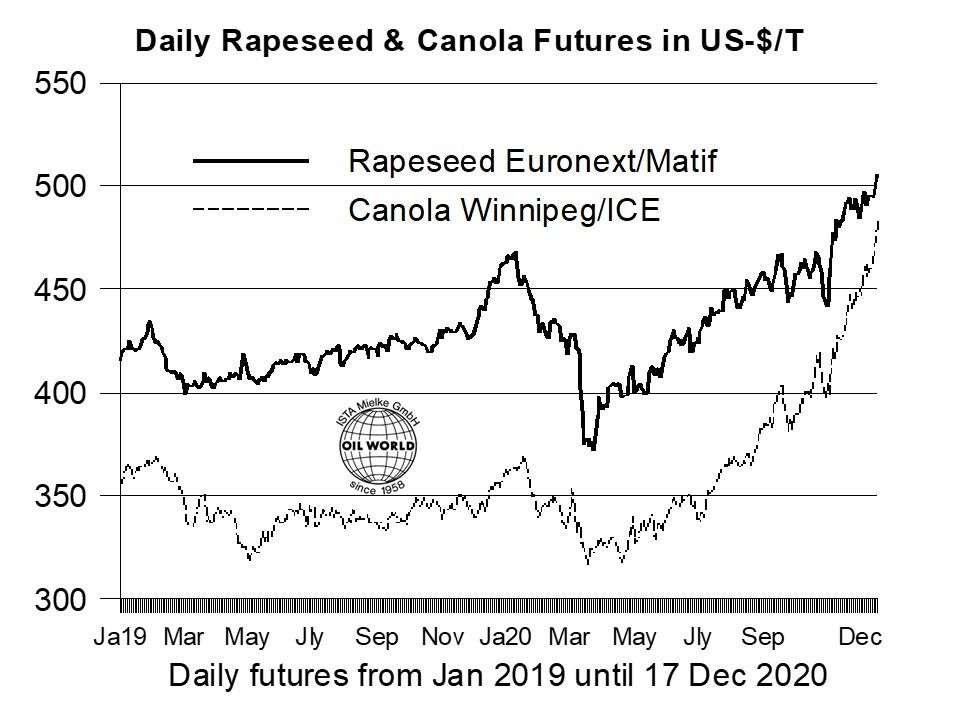

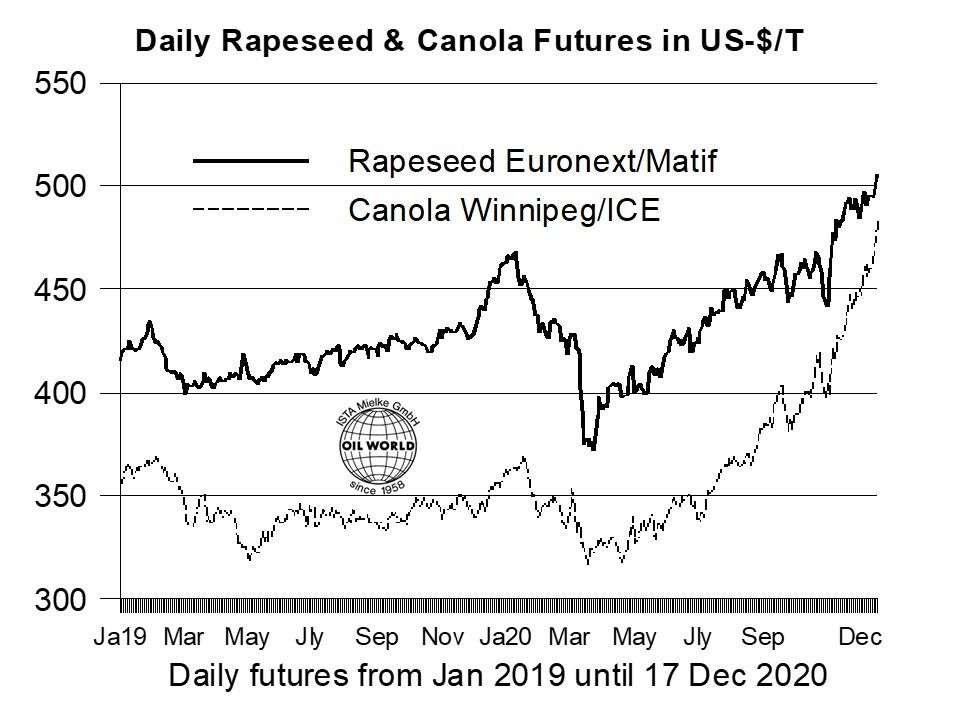

Economic situation

The value of rapeseed in the EU is currently undervalued. Meanwhile, Canadian rapeseed futures (January position) rose to C$615.20 at the close on Dec. 17, the highest level for the near-term position in seven years. Continued large sales of Canadian rapeseed and rising vegetable oil prices are seen as key reasons for the 9% increase in Winnipeg rapeseed futures over the past 30 days.

This contrasted with the sideways trend in EU rapeseed futures on MATIF: February contracts closed December 17 at €413.00 (versus €410.25 on November 17). These diverging price trends significantly reduced the profitability of Canadian rapeseed imports into the EU. Meanwhile, the premium on EU futures was only $21 compared to $55 a month ago, and peaked at $94 as early as July 2020.

Because current prices make importing Canadian rapeseed into the EU unattractive, EU processors are consuming more rapeseed produced within the Union, which will result in more rapid inventory drawdowns and higher prices for EU rapeseed in the coming months.

This season, the European Union (note: still including the U.K.) is already seeing a decline in stocks. The latest OIL WORLD data shows that EU rapeseed stocks were down about 0.8-0.9 million tons at the end of December due to lower domestic production, reduced imports (mostly from Ukraine) and relatively high levels of processing.

Nevertheless, Australian rapeseed imports into the EU should increase significantly in January/June 2021, leading to an increase in total third-country supplies to a new high in the second half of the season. Australian rapeseed imports into the EU this season can be expected to be 1.9-2.0 million tons.

In contrast, imports from Ukraine and Canada will probably not reach the level of a year ago. High EU rapeseed prices are needed in the near to medium term to support import growth.

Over the past two seasons, EU-28 countries have used approximately 0.6 million tons of sunflower oil to produce biodiesel (annually). However, high price premiums have made this raw material uncompetitive in the energy sector. Thus, European biodiesel producers will need large volumes of rapeseed oil and other raw materials in October-September 2021 to replace sunflower oil. This is likely to further support rapeseed and rapeseed oil prices in the EU in the coming months.

Обсуждение